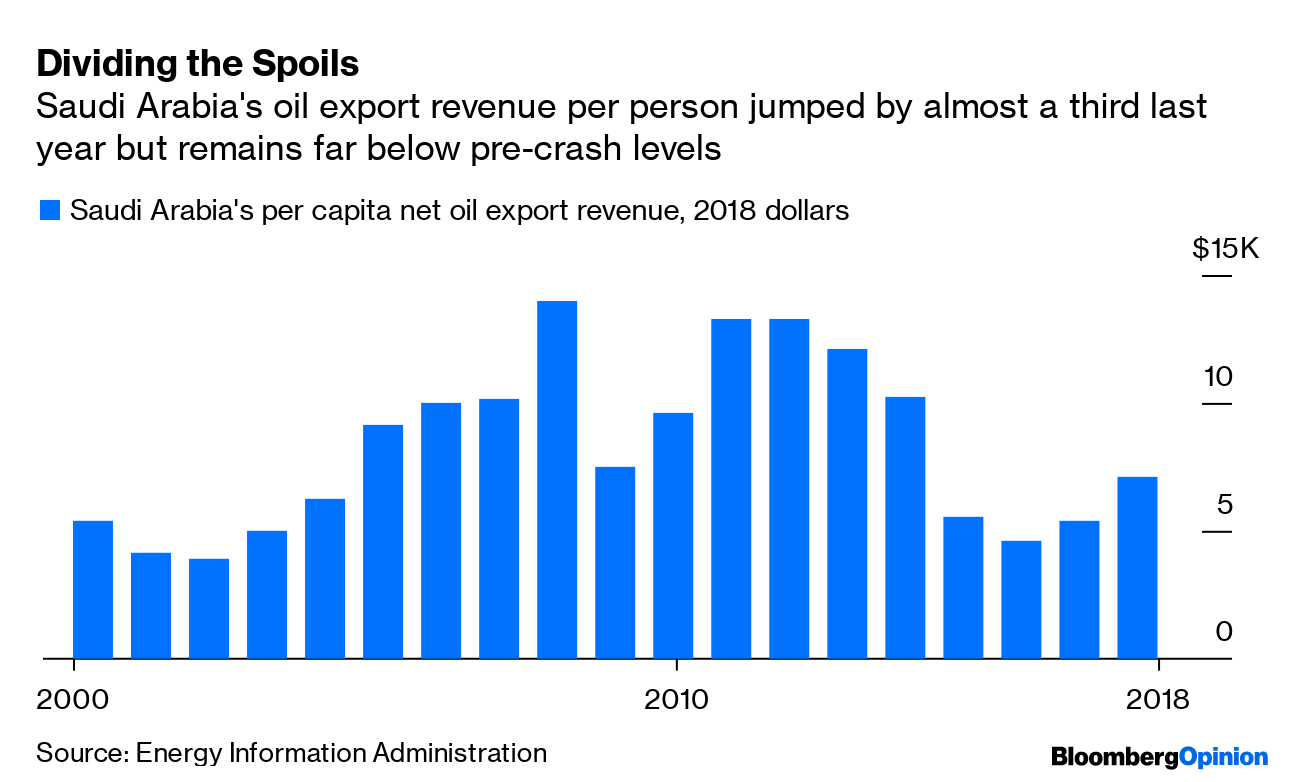

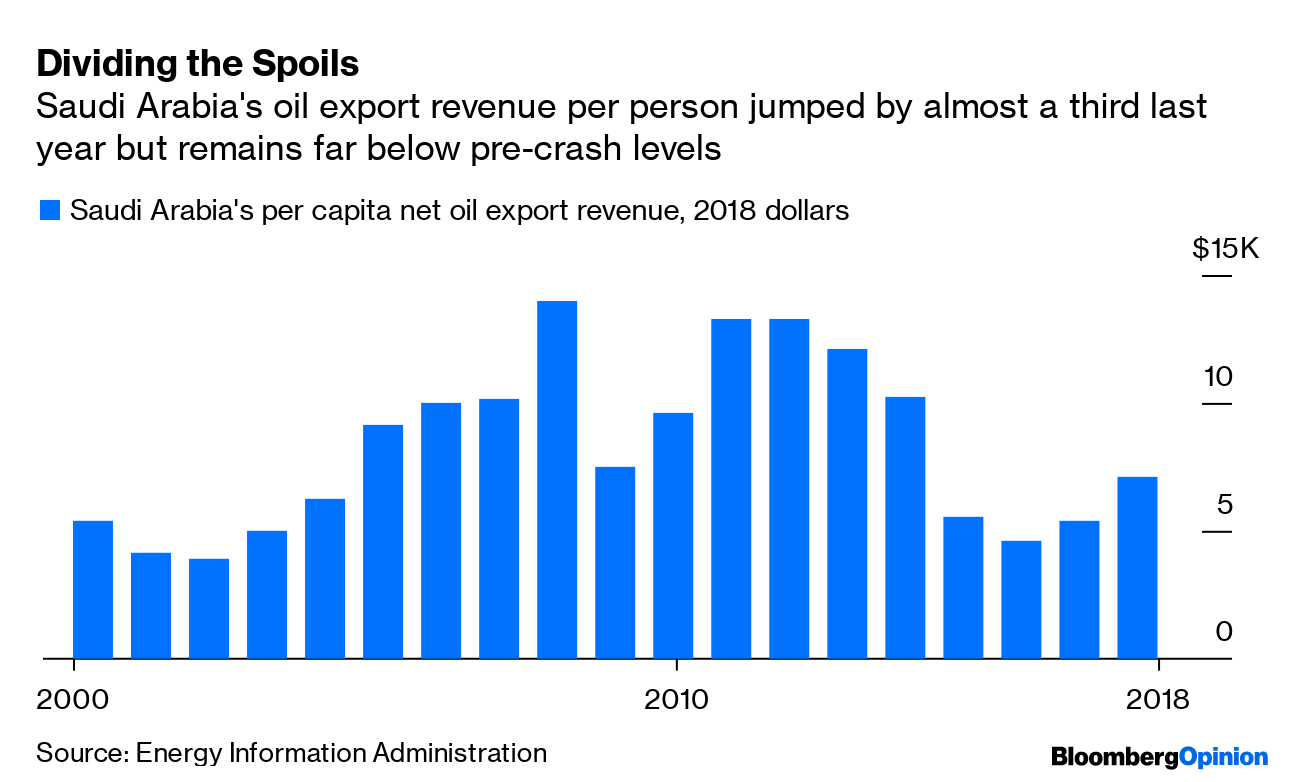

Today's Agenda  The Power of the People to Surprise Popular movements can have unexpected power to spur change, and China is no exception — that is, when the people care. China has a long history of defying predictions, and now it may be mistaken to believe that China's top-down rule is here to stay, Tyler Cowen writes. Yes, in 2001, when many believed greater political and social liberty would soon follow China's entry into the World Trade Organization, they turned out to be wrong. Outsiders were also wrong to predict a decade ago that China's economy would crack. There are many other recent and historical episodes of incorrect groupthink on China. Now the conventional wisdom is that China won't liberalize — basically the opposite of the post-WTO consensus. But that view may be simplistic, Tyler says, and doesn't account for humans' capacity to respond to current events and shape their futures to the better. Even China's cloistered version of the internet has been too quickly dismissed as a liberalizing force. Modern China may surprise again. Adam Minter also says movements of Chinese citizens have forced the government to address poor air quality and other episodes of environmental destruction, but popular pressure may not be effective on climate change. That's because a recent national survey found most of China's citizens are not worried about climate change, and Adam says the world's biggest emitter of climate-changing carbon may find it easy to cast aside carbon-reduction commitments without citizens' intervention. There are, however, a couple of forces in China that are weaker than people believe. One is the notorious state propaganda machine. State-backed media and the "Great Firewall" that blocks or steers what people say and see online are effective at shaping public opinion inside the country. But, Adam Minter writes in a second column, the clumsy state-backed social media campaign that sought to undermine Hong Kong protesters underscored Beijing's struggles to effectively project its propaganda outside of China. Shuli Ren says it's also fine to underestimate China's banks. It's tempting to worry that banks coordinating on China's new market-driven benchmark loan rate will devolve into something like the Libor-fixing scandal involving Western bankers. But Shuli says China's banks are too dysfunctional for collusion to work. Are You Not Entertained? Technology and media companies are setting truckloads of cash on fire to reshape in-home entertainment and (eventually, they hope) make money. Netflix Inc. is a cash bonfire king, and the likes of Apple Inc., the telephone company that owns HBO, Walt Disney Co., Comcast Corp. and many others are spending gazillions on internet-delivered movies and lush series that they hope people will pay to watch in their living rooms or on their smartphones. This land grab for eyeballs, Tara Lachapelle writes, is funding some incredible creations, but it's also kind of terrible. Companies are at risk of overspending for what might be mindless background distractions, and a flurry of internet-entertainment services creates frustration for people who need to use a string of apps to watch what they love. Political Crisis, Just in Time for Beach Holidays Ah, Italy, where political chaos is always just around the corner. Perfectly timed for sand and gelato season, Italy's government collapsed on Tuesday when Prime Minister Giuseppe Conte announced his resignation. In a speech, Conte vented rage at the recent power grab by his own deputy that effectively ended the current governing coalition. The rogue minister, Matteo Salvini, was seated next to Conte during his rant. Awkward. The prime minister's speech and resignation, writes Ferdinando Giugliano, was a "festival of hypocrisy" staged by three political leaders, and it left Italians no wiser about the direction of their country. Before Conte's resignation, Bloomberg's editorial board wrote that the European Union should resolve not to make Italy's upheaval worse by ensuring that the country isn't left to shoulder an unfair share of helping refugees, and recognizing that the EU's blunt approach to fiscal discipline in member countries has unintended consequences — such as helping populists shift the blame to outsiders. Related reading: "Volcker 2.0" Isn't the Name of the Worst-Selling Transformer U.S. banks have long been waiting for a financial crisis-era easing of restrictions against making speculative investments, and they got that on Tuesday. But Brian Chappatta writes that "Volcker 2.0" might not revive the waning trading business on Wall Street, because times have changed — a few tweaks aren't going to make hedge funds thrive again, nor stop the pace of technological progress that has narrowed spreads across markets. Banks should want to step back from risky trades during times of market stress, Brian says, not necessarily because they're forced to, but because they might lose their shirts and, you know, possibly bring down the entire financial system. Remember when that almost happened? Telltale Charts Disappointing results at the Kohl's Corp. department-store chain masked a recent sales upswing and promising catalysts such as additions of prominent merchandise brands and a partnership with Amazon, Sarah Halzack says.  If you want to understand why Saudi Arabia is reviving IPO plans for its state oil company, Liam Denning has some charts for you:  Further Reading Having workers in the boardroom brings unexpected benefits. —Noah Smith The least-bad option in Afghanistan is a U.S. presence for the foreseeable future, and not an unenforceable peace with the Taliban. —Eli Lake The owner of France's Monoprix supermarket chain is tackling its debt, which may help the investment vehicle of the company's CEO. —Andrea Felsted It's pointless to debate the exact date on which slavery of Africans started in the U.S. The commemoration is what matters. —Stephen L. Carter U.S. business spending on items such as office buildings, software and agricultural equipment is not showing the signs of excess that tend to presage an economic downturn. —Conor Sen The firing of the New York police officer blamed for choking Eric Garner shows the U.S. legal system's inability to address social change. —Noah Feldman There are a couple of constructive ideas in a new bill seeking to curb private equity's worst practices. —Bloomberg's editorial board Resist the temptation to broadly buy into emerging market stocks and currencies. —Mohamed A. El-Erian The FDA's rejection of a drug for a deadly muscle-wasting disease may signal the agency's shifting standards for approval. —Max Nisen ICYMI Trump is considering several tax cuts. Jeffrey Epstein wrote a will two days before his suicide. A new Bank of England head may wait until after Brexit. Kickers The answer, my friend, is air mattresses blowin' in the wind. A particularly mean rooster in Arkansas has been contained. (h/t to James Greiff) A New Zealand sculpture is "Hamburger Helper looking for his glove." (h/t Mike Smedley) Neanderthals suffered from an epidemic of swimmer's ear. (h/t Scott Kominers) Note: I'm filling in this week for Mark Gongloff. Please send pistachio gelato and complaints to Shira Ovide at sovide@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

No comments:

Post a Comment